Dec 26, 2009

Make sure to include an inspection addendum even when buying a home as is.

FAR/BAR As Is Contract

When buying a home “as is” you might want to consider using the FAR/BAR As Is contract. The FAR/BAR As Is contract allows the buyer to cancel their contract with the seller if after the inspection the buyer deems the property unacceptable.

FAR as in addendum

Another choice available to you is the FAR As Is With Right to Inspect addendum that you can attach to the contract. The as is addendum gives the buyer the right to inspect the home and to cancel the contract if the cost of repairs exceeds an amount decided on in negotiations or if left blank on the addendum the contract allows for cancellation if the amount exceeds $250.00.

Make sure you protect yourself when buying a home as is. You should be careful about giving up your right to inspect the home you are purchasing and you should negotiate with the seller the ability to cancel the contract if your inspections reveal major issues.

Related Florida real estate blog posts on home inspections

Tax credit + REO + Short sales = Home sales in 2010

Tax credit + REO + Short sales = Home sales in 2010

In order for this formula to be successful potential buyers who could qualify for the first time home buyer and long-time home buyers need to be aware of the limited time the tax credit is available to them. We will be getting the tax credit message out with a combination of traditional methods and online marketing.

The REO and short sale market will continue to be strong according to most reports during the first quarter of 2010. Some are reporting a huge supply of bank owned, REO property will be hitting the market during January, February and March of 2010.

In my office we enjoyed a significant increase in homes sold during 2009 compared to 2009. I expect the number of houses sold during 2010 to surpass the number sold in 2009 throughout the Orlando-Kissimmee Central Florida area.

Related Florida real estate blog posts on home sales

Dec 23, 2009

What is the long-time resident home buying tax credit?

The expansion allows the qualifying long-time resident home buyer to receive up to $6,500 tax credit if they buy, are under contract to buy, a replacement home they will use as their principal residence after Nov. 6, 2009, and on or before April 30, 2010, and close on the home by June 30, 2010. An additional qualification factor for the long-time residence is that they must have lived in the same principal residence for any five-consecutive-year period during the eight-year period.

If you own a home and are thinking about buying another home to use as your personal residence, give me a call to discuss the long-time residence tax credit.

Related Florida real estate blog posts on home buyer tax credit

The information only a local real estate agent can provide you.

Information only a local real estate professional can provide you.

My office recently received a call from a person who lives up north who is “thinking” of buying a home in the Kissimmee area. The buyer has informed us that they are retired and while they would like to buy a home in this area, the home they will be interested in will be a home on a local lake or river because, “we plan on doing a lot of fishing”.

It just so happens I have an agent in the office that does “a lot of fishing”. He knows the local lakes and rivers; he knows where the fish can be found. Having lived in the area for many years our agent was able to send the buyer an email that provided information the buyer needed. The email sent had nothing to do with real estate taxes or the best rates available, all the typical information we provide as real estate professionals, no this email talked about where the biggest large mouth bass can be found, it discussed fishing on the St. John’s River, boat docks and available housing around the area lakes. The customer received a first hand account of what was important to them. When they decide to buy they will be able to do so with confidence because their agent knows the area and can help them find the right home.

There is a huge amount of information available online that buyers and sellers can use when buying or selling real estate. But when it comes to finding local information, like where are the best fishing holes, your best bet is in contacting an agent who lives in the community.

Related Florida real estate blog post on real estate agents

Top 5 Central Florida Cities with Short Sale Listings

So which Central Florida cities have the majority of short sale listings available to buyers? The following are the top 5 cities in Central Florida with the largest short sale inventory as of this post.

Top 5 Central Florida Cities with Short Sale Listings

- Orlando - 2,694 short sales. Short sales in Orlando range in price from a low of $9,900 to just over $2 million. 1,152 of the active inventory are condos or townhomes. 1735 are listed as single family homes.

- Kissimmee – 1,096 short sales. Prices of short sales in Kissimmee range from $8,500 to $250,000. 359 of the Kissimmee short sales are condos or townhomes.

- Deltona - 396 short sales. Deltona short sale prices are between $24,000 and $259,000. Residential detached homes make up 394 of these short sales.

- Apopka – 272 short sales. Prices in Apopka run from $24,000 to just over $300,000. The majority of the Apopka short sales are residential homes.

- Saint Cloud short sales. Saint Cloud is the second Osceola city on this list. List prices run from $34,000 to nearly $700,000.

If you are interested in purchasing a short sale you should use a real estate agent who is qualified to help you with the transaction from start to finish. As a Certified Distressed Property Expert, I have the skills and know-how to help you find, negotiate and close a short sale transaction. Give me a call today to begin the process.

Dec 21, 2009

Fannie Mae allows renters of foreclosed homes the opportunity to stay in their homes

Fannie Mae allows renters of foreclosed homes the opportunity to stay in their homes

If you are renting a Fannie Mae owned home and the home has been foreclosed on or been deeded-in-lieu of foreclosure, you have options that include staying in the home.

Fannie Mae Rental Policy

The Fannie Mae rental policy applies to tenants who live in any type of single family housing including:

- 2-4 unit properties

- Condos

- co-ops

- Manufactured housing

- Detached homes

The homeowner association must not prevent rentals in the community. A real estate broker or a property management company will manage the property for Fannie Mae. Renters will have the option of a payment if they wish to move to other housing or can sign a month-to-month lease.

For additional details you can call 1-800-7FANNIE (1-800-732-6643).

Dec 20, 2009

Guest Bedroom. My next house will have a guest bedroom!

Many homeowners have decided after the holidays or whenever family or friends stay over for an extended period of time that the next home they purchase will be a home with a guest bedroom.

During 2010, purchasing a home with a guest bedroom makes sense when you consider the positives of buying a home now.

- If it will be the first home you will own, you may qualify for up to $8,000 in tax credit money.

- If you own a home now, you may still qualify for up to $6,500 in tax credit money.

In addition, home prices are as low as they have been in years. In Florida you have many choices when searching for homes with guest bedrooms. You can choose from homes with;

- mother-in-law suites

- attached apartments

- homes with two master bedrooms

- homes with 5 bedrooms plus

So many choices and so many reasons why buying a new home now is a good idea. If buying a home with a guest bedroom is in your plans, give me a call to receive a free list of available homes in your price range and area.

State Farm Staying, Dropping Policies, Raising Rates

"This agreement is the product of a long and arduous negotiation process,” remarked Commissioner McCarty. Read full press release

The agreement allows for State Farm to non-renew policies and increase rates. According to a press release issued by State Farm, customers who will not have their policies renewed will receive a six-month advance notice. Rate increases will happen as policies are renewed. Describing the Florida property insurance market as “not easy times”, the steps being taken are necessary in order to stabilize State Farms financial condition in Florida.

Related Florida real estate blogs related to insurance

I find a house for sale online but when I call about the house, it has already been sold. Help!

Ask me to help.

As a full time real estate agent I have systems in place that let me know immediately when a new home comes on the market. This way, I never miss an opportunity to let a customer or client know when a home that matches their area, price and size enters the market place.

The good news is that I can set up the same time of alert system for you. After we have had a chance to discuss your real estate needs, I can enter your search criteria into my MLS program and you will receive automatic updates by email of new listings that match the features you have provided.

What does this cost?

I provide this service to those buyers who have agreed to work with me absolutely free! That’s right, there is no cost to you. You will start receiving results in your email box almost immediately. Of course the good deals do go quickly, so when a house is emailed to you that you find interesting, you will not want to delay scheduling a time to view the home and hopefully making an offer.

Are you ready to get started? Call me 407-304-0255.

Related Florida real estate blog posts on buying a house

Dec 19, 2009

Should you attend the home inspection?

Buyer

As the buyer you should make every effort to attend the inspection. The inspection process is your opportunity to discover hidden defects. The inspector will alert you to repair and maintenance issues. I would not suggest depending on a third party to relay the information to you after the fact. Your real estate agent will most likely be there with you but you should not count on your agent to be your eyes and ears. Schedule a time with the inspection company that allows you to be there.

Seller

If you do plan on attending you will want to make sure you do not interfere with the process. You should stay out of the way of the buyer and their inspector, allowing them the space they need to accomplish their task and to discuss their findings in private. You may want to have warranties and/or recent repairs or maintenance information available should the inspector or buyer ask for them.

The goal of the home inspection is to move both parties one-step closer to closing the transaction. Buyers and sellers who understand their roles in the home inspection will help expedite the process.

Related Florida real estate home inspection blog posts

Dec 17, 2009

Short sale reasons

- A situation that requires the homeowner to have to relocate or move from the home

- Loss of job or reduction of wages

- Health issues or concerns that prevent the homeowner from working

- Divorce

- Medical costs

- A closing or failure of a business or self employment

- Death of a spouse

- Increase in mortgage payment or other monthly obligations

Any situation that creates a hardship and makes it impossible for the homeowner to repay their mortgage might be considered by the lender as a valid reason. Please contact me to discuss your personal situation.

Dec 13, 2009

Orlando Christmas Holiday Lights Celebration

- Music

- Treats

- Polar Express movie

- Santa Claus

Dec 11, 2009

If I have never owned a home & buy a house for investment only with no plans of living in the home, do I qualify for first time home buyer tax credit

If you have never owned a home and you purchase a home strictly for investment with no intention of moving into the home as your primary residence, your purchase will not qualify for the tax credit. The IRS describes the home that qualifies as; “Main home. Your main home is the one you live in most of the time.”

There are other qualifications such as income guidelines you will need to meet in order to qualify for the first time home buyer tax credit. If you are interested in purchasing a home and would like to learn more about the tax credit, give me a call. 407-304-0255

Related Florida real estate view tax credit blog posts

Dec 7, 2009

Emergency unemployment compensation extension provides up to 20 additional weeks of benefits

“The online application will accelerate our ability to provide these critical federal benefits to thousands of eligible unemployed workers,” said Director Lorenzo.

Related blog posts on unemployment

Dec 6, 2009

Central Florida real estate listings

The extension and expansion of the homebuyer tax credit, low mortgage interest rates, and short sales, REO, foreclosures and pre-foreclosures continue to draw buyers into the market place. The good news is that there are still plenty of Central Florida listings to choose from. However, as 2010 begins, the best deals will surely be picked up quickly.

I have examined the current inventory of Central Florida listings for:

- Osceola County

- Orange County

- West Volusia County

- Seminole County

- Lake County

As of this post there are 23,748 residential listings being reported as available. Of those available listings:

- 2,046 are bank owned/REO

- 7,908 are subject to short sale

- 13,784 are listed as neither short sale or REO

Additionally when breaking down the listing inventory by price the results are:

- 6,174 are priced at $100,000 or less

- 14,655 are priced at $200,000 or less

Central Florida real estate listings include condos, homes, and town homes. New construction, waterfront, historic and gated community homes are part of the many different types of homes for sale.

If you are going to buy a home in December or at the start of 2010, now is the time to call me to start looking for just the right home for you.

Nov 30, 2009

Everyone lives in a flood zone

When purchasing a home one of the clauses in the FAR9 contract deals with advising the buyer to verify by survey, the lender, and/or with government agencies which flood zone the house or property is in. The Flood Zone clause also allows the buyer to determine in flood insurance is required.

Determining if the home or property you are considering purchasing will require flood insurance is just one of the many steps you should take before closing on the transaction. Call me to discuss all of the inspections and precautions you should take before closing on your next home.

Related blog posts on home inspection

Nov 29, 2009

Citigroup continues progress in its efforts to help distressed homeowners avoid potential foreclosure

- Modifications

- Extensions

- Forbearances

- Reinstatements

Sanjiv Das, President and Chief Executive Officer of CitiMortgage, "We recognize the difficulties that homeowners face in the current economic environment and our number one priority is to help keep homeownership a reality for our customers who find themselves in financial distress."

Are you behind on your Citi mortgage? You should contact Citi immediately and talk to them about your options. Visit Citi's homeowner assistance information page for more information.

Nov 28, 2009

Homestead exemption in Florida is filed with the Property Appraiser's office where the home is located

Nov 27, 2009

Customarily the Seller will provide the Buyer of their home, title insurance.

· Claims by others who may have a hidden interest in the property.

· Documents that were missed, unsigned, not recorded or prepared wrong.

· Fraud

· Unmarketable title preventing the home from selling in the future.

· Liens

I say customarily because it is not a law that the Seller provide the coverage. Buyers making offers on bank owned property are often finding the bank unwilling or unable to pay for an owner’s title insurance policy. As a matter of fact the FAR9 purchase contract offers 3 choices.

1. Seller selects title and pays for title policy

2. Buyer selects title agent and pays for title policy

3. Buyer selects title agent and Seller pays for title policy

Regardless of who pays, the Buyer will want the peace of mind an owner’s title policy will bring. Making sure this is negotiated in your contract is important and is another reason why you should consider using our services when buying or selling a home in Florida.

Related blog posts about buying a home

Nov 21, 2009

Flash forward to May 1, 2010 and here is what you won't see.

For anyone thinking of purchasing a home in the near future, here is a helpful flash forward that does not involve blacking out or visions.

If you flash forward to May 1, 2010 and you have not entered into a binding contract to purchase a home, you won't be seeing up to $6,500 or $8,000 tax credit. The extension passed by our Government on November 6, 2009 only allows the majority* of home buyers to take advantage of the tax credit as long as they are under contract by April 30, 2010.

If you believe you are ready to purchase a home in 2010, make sure you do so in plenty of time to qualify for the home buyer tax credit.

Tax credit extension adds a closing cushion that could help buyers who are trying to purchase a home subject to short sale.

*Members of the uniformed services, members of the Foreign Service and employees of the intelligence community serving outside the U.S. have an extra year to buy a principal residence in the U.S. and qualify for the credit.

Nov 20, 2009

Do I have to sell my home to qualify for the up to $6500 home buyer tax credit?

Do I have to sell my home to qualify for the up to $6500 home buyer tax credit?

One of the questions being asked about the new tax credit of up to $6500 for home owners buying a replacement home is does the home buyer have to sell their current home to qualify for the up to $6500 home buyer tax credit?

The IRS addresses this question on their First-Time Home buyer Credit Questions and Answers: Homes Purchased in 2009 page:

Q: I’m already a homeowner. If I buy a replacement home after Nov. 6, 2009, to use as my principal residence, do I have to sell my home to qualify for the home buyer tax credit?

A: If you meet all of the requirements for the credit, the law does not require you to sell or otherwise dispose of your current principal residence to qualify for a credit of up to $6,500 when you buy a replacement home to use as your principal residence....

You should speak with an attorney or tax professional to receive additional information and help in determining if you qualify for the tax credit.

Nov 16, 2009

Houses subject to short sale may not be for all Florida buyers

A buyer will need patience. Short sale listings can take several weeks or months just to receive an answer from the seller's lender. The time it takes for a short sale to receive a response depends in part on the short sale processing skills of the listing agent, the cooperation and situation of the home owner, the number of mortgages on the home, and the lender's short sale negotiator or loss mitigation department. In October the median days to close a short sale transaction in Osceola County equaled 220 1/2 days according to information found in the MLS.

Buyers who have no time to wait and need a house now, may choose to ignore the short sale market in favor of well priced traditional listings or REO property.

Related blog posts on short sales

Nov 15, 2009

FHA insured loans are a popular choice among first time home buyers

FHA offers an affordable way for buyers to obtain a home loan. When I practiced real estate up north, FHA financing was a fairly common source for mortgages. Some of the benefits to a Florida home buyer using an FHA insured loan include:

- Approximately 97% financing

- The loan is subject to appraisal

- The home must meet minimum property conditions

It is easy to apply for an FHA loan. Watson Mortgage handles FHA loans and offers the buyer free consultation to determine if FHA is the right program for you.

Nov 14, 2009

Florida residents have until April 30, 2010 in order to qualify for tax credit

Buyers who want to take advantage of the complete housing inventory will want to start looking for a home soon if they plan on qualifying for the tax credit. The length of time it takes for a short sale transaction to close and the multiple offers being received on bank owned property is increasing the time it takes for a buyer to find a home, receive an accepted offer, remove financing or inspection contingencies and finally close on their home.

Related blog posts on tax credit

Condo Board Member Responsibilities

The event will be from 5:30pm - 7:30 pm at the:

Satellite Beach Library

751 Jamaica Blvd.

Satellite Beach, Fla. 32937

DBPR news release

Related blog posts on DBPR

Nov 11, 2009

291,309 foreclosure cases are currently pending in Florida

The Florida BAR News article addresses the need in the minds of some for a mediation program that would allow home owners and the lenders potentially to avoid foreclosure or assist in speeding up the process.

According to the report 95% of Floridians facing foreclosure do not have an attorney.

Related blog posts on foreclosures

Nov 8, 2009

Florida foreclosures waterfront

If you are interested in waterfront pre-foreclosures, foreclosures and short sales listed for sale in Florida you are in luck. There are a number of available homes for sale in the Central Florida market area including homes on the following Orange County Lakes.

Lake waterfront foreclosures

Orange County

- Lake Luai - Orlando

- Lake Emerald - Orlando

- Lake Haverlake - Apopka

- Lake Apopka - Apopka

- Lake Gibson - Orlando

- Lake Hourglass - Orlando

- Lake Davis - Windermere

- Lake Hancock- Winter Garden

- Lake Whippoorwill - Orlando

- Big Sand Lake - Orlando

- Lake Sawyer - Windermere

- Lake Caywood - Windermere

- Lake Avalon - Winter Garden

These are just a few of the lakes where you can find pre-foreclosure, foreclosure and short sale homes for sale. I can also provide you with waterfront information that includes Seminole, Osceola, Lake and Volusia Counties.

The list of waterfront foreclosures can also include homes on the ocean, canal, river and ponds.

How Florida home sellers can benefit from tax credit extension and enhancement

- If you do not have your home on the market, the extension and enhancement signed into law recently provides the perfect window to do so. In addition to extending the first time homebuyer tax credit the enhancement allows current homeowners to receive up to $6500, which will draw additional buyers into the marketplace increasing the number of potential buyers viewing your home.

- The up to $8,000 or $6500 tax credit that qualified buyers will receive coupled with any buyer incentives you offer will help your home stand out above the competition. Offering to assist with buyer closing costs and/or pre-paid when allowed, provides the buyer even more reasons to make an offer on your home.

- Real estate agents are excited and will be leaving no stone unturned, using the extension and enhancement as a main focal point of their marketing and prospecting. This message will reach more potential homeowners increasing the odds of finding the right buyer for your home.

- There is a time limit. In order to qualify for the tax credit buyers will need to have an offer on a home on or before April 30, 2010. This will work to create a sense of urgency resulting in high quality offers and serious buyers.

- You may be able to use the tax credit to buy your next home. If you have owned your home as a primary residence for 5 consecutive years out of the past 8 and meet the additional guidelines, you will be able to take advantage of the tax credit on the new home you purchase after selling yours. You may find the up to $6500 you receive with your next purchase will give you a little more wiggle room when negotiating with a buyer for your home.

The key is in not delaying. If you are thinking of selling your home, call me to discuss market conditions, the tax credit and your personal situation.

Homeowners in Florida may qualify for a pre-foreclosure sale-short sale

- You are facing a financial hardship that prevents you from paying your mortgage payment as agreed.

- You have been unable to work out a solution with your lender; loan modification, forbearance, repayment plan.

- Your home is no longer worth what you owe on it.

Before agreeing to short sale your home you should consult with a real estate agent, a tax accountant and an attorney to determine for yourself that a pre-foreclosure short sale is the correct course for you.

Homeowners facing foreclosure may be able to remain in their homes

Homeowners who qualify and agree to give their home back to the lender via a deed in lieu will then be allowed to lease back the home at a payment in line with the current market. Other considerations in order to participate include:

- Home must be primary residence

- Rental rate cannot exceed 31% gross income

- 12 month lease period

- Inspection of the property to determine house has been maintained

To find out if you have a loan that qualifies for the Deed for Lease™ program contact your mortgage service. For additional information visit Fannie Mae.

Nov 7, 2009

The tax credit extension adds a closing cushion for buyers who are trying to purchase a home subject to short sale.

Short sale transactions can take up to 30-60 days or longer. Before the extension passed, buyers were leery of making an offer on a home listed with a short sale contingency for fear they would miss the November 30th cutoff date. With the new tax credit extension, buyers may not have to avoid making an offer on a short sale, knowing that they now have 60 days in order to close.

Buyers will still want to consider the possibility of the short sale not being approved in time and should consult with their agent, tax advisor and attorney for guidance before making an offer.

Related blog posts on tax credit

Related blog posts on short sales

Orlando driver license

The following are the addresses and phone numbers as they are listed on the State Motor Vehicle site where you can pick up driver licenses, driving tests and ID Cards.

- 11764 E. Colonial

(407) 445-5462 - 4101 Clarcona Ocoee Road

(407) 445-5462 - 11210 S. Orange Blossom Trail

(407) 836-4145 - 4576 South Semoran Blvd.

(407) 836-4145 - 2110 W. Colonial Drive

(407) 836-4145 - 301 S. Rosalind Avenue

(407) 836-4145 - 11967 E Colonial Drive

(407) 836-4145

The following are the addresses and phone numbers as they are listed on the State Motor Vehicle site where you can register, tag and title cars and trucks.

- 11967 E. Colonial Drive

(407) 836-4145 - 4576 S. Semoran Blvd

(407) 836-4145 - 11210 S. Orange Blossom Trail

(407) 836-4145 - 2110 W. Colonial Drive

(407) 836-4145 - 301 S. Rosalind Avenue

(407) 836-4145

Give me a call if you have questions about Orlando or if you are moving or relocating to the Orlando area.

Nov 5, 2009

Florida home buyers will benefit from extension and enhancement of tax credit

Once the extension and enhancement becomes law I will post the details that include a tax credit for existing home owners too.

Related blog posts on home buyer tax credit

Nov 4, 2009

It is ok; we do this all the time.

I just finished reading a press release posted on the Florida Association of Realtors website announcing the arrest of over 100 people in Florida for mortgage fraud. I wonder how many times those persons arrested uttered the words, “It is ok; we do this all the time”?

I am not saying every time someone says those words they are trying to do something illegal or committing mortgage fraud. But the facts are if whatever it is, is legal and done all the time by professionals in this business, I am going to be fully aware of it and you will not need to tell me.

Related mortgage fraud blog posts

Nov 2, 2009

License requirements to be a home inspector

Purpose.—The Legislature recognizes that there is a need to require

the licensing of home inspectors and to ensure that consumers of home

inspection services can rely on the competence of home inspectors, as determined

by educational and experience requirements and testing. Therefore,

the Legislature deems it necessary in the interest of the public welfare to

regulate home inspectors in this state. CHAPTER 2007-235

Related Florida real estate view blog posts about home inspections

Nov 1, 2009

More studies needed to determine connection between Chinese Drywall and health problems

"While the studies have discovered certain differences between Chinese and non-Chinese drywall, further studies must be completed to determine the nexus between the drywall and the reported health and corrosion issues."

Related blog posts on Chinese Drywall

Has the tax credit been extended and expanded for Florida?

The National Associations of Realtors is asking that we call our Senators.

Please make a quick call to your Senator's office today to ask for cloture*Related blog posts on the tax credit

on the Unemployment Insurance Extension bill that contains the tax credit

provision. This cloture vote is scheduled for Monday evening. Sixty

Senators must vote yes so that a vote can be scheduled on the tax credit.

Casselberry will host a lakefront workshop

- water quality

- floodplains

- vegetation characteristics

- plant identification

For additional details and contact numbers and emails, please visit the City of Casselberry press release.

Who do you call if you are behind on your house payment?

- Bank of America: 1-800-720-3758

- U.S. Bank: default resolution 1-866-932-0462 default counseling 1-800-365-7900

- Wells Fargo: 1-800-678-7986

- Citibank: 1-866-915-9417

- Fifth Third Bank: 1-866-601-6391

- Huntington National Bank: 1-877-477-6855

- Sun Trust Bank: 1-888-886-0696

- Regions Bank: 1-800-748-9498

- HSBC: 1-800-338-6441

I will continue to add numbers as I find them. Several of these numbers were harder than it should have been to locate on the bank web page. I would have thought a bank would look for ways to make it easier for their customers to call them when falling behind on payments, like put the toll free help line on the front page.

For help with housing needs, you can find the nearest HUD-approved counseling agency on the web or by calling 1 (800) 569-4287.

Oct 30, 2009

How to do a short sale on a home

In order to do a short sale you will need to provide your lender with documentation that will be used by them to determine if your personal situation qualifies for them to accept less from you than is owed. This documentation will include:

- Mortgage information and statements for all mortgages on the home

- Personal accounts information including your checking and savings accounts

- Income documentation including recent pay stubs and tax returns

- Financial worksheets and a hardship letter written by you that explains why you are unable to make your mortgage payments and what prevents you from selling your home for the full amount owed.

Providing your lender this information is one of the first steps on how to do a short sale on a home. If you believe a short sale will help you or someone you know, call me to learn more about the process.

Related Florida real estate views:

Does a short sale impact your FICO® credit score the same way a foreclosure does?

Oct 28, 2009

Buying a short sale house

Buying a short sale house

A buyer of a short sale home needs to understand the differences in processing the transaction.

- The time to close could be extremely long.

- The seller may not be able to make repairs to the home.

- The seller may have had power disconnected that would require the buyer to turn on utilities for their inspection.

- The lender may simply choose to ignore the deal completely and foreclose on the home.

With thousands of homes being offered for sale subject to a short sale, a home buyer would not want to ignore the possibilities of purchasing one of these homes. Patience and caution are suggested if you get involved with a short sale transaction. It would also be wise to use the services of a real estate agent qualified to navigate the short sale process successfully.

Related Florida real estate views:

We have made multiple offers on bank owned homes in our area without success.

Oct 26, 2009

The unemployment rate in Florida will create short sale situations for home owners

Short Sale

A short sale is created when a home owner is caught up in a distressed situation that makes it impossible for them to make their monthly mortgage payments. When modification or refinancing is not an option, the home owner can choose to list their home for sale, subject to their lender agreeing to accept less than is owed. The loss of a job is a valid reason to approach a lender about short selling the home.

Why would a seller choose to short sale?

Faced with short selling or foreclosure, a home owner may decide on short selling with the future in mind. Eventually the seller will find new employment and may want to start to saving money with the goal of buying another home. A foreclosure on their credit report will increase the number of years it might take to find a lender to approve them for a loan as compared to a short sale.

Each situation is different and if you have recently lost your job and are falling behind on house payments, call your lender immediately. You may also want to speak with an attorney about your personal situation. If you decide your best course of action is selling subject to a short sale, then call me. As a Certified Distressed Property Expert, I can help you work through the short sale process.

Related Florida real estate views:

Are you caught in a situation where you owe more on your mortgage than your house is worth?

The time it takes to close a short sale transaction

Is there a difference in how they impact your credit scores?

Oct 25, 2009

How do you compete with the other 6,000 plus home owners selling their home as a short sale?

Your situation is not unique. Short sale listings make up a large portion of the active real estate inventory. So how do you compete with over 6,000 plus home owners selling their home as a short sale? That's right, right now in the 4 counties mentioned there are over 6,000 homes listed for sale subject to the lender accepting a short payoff.

How do you make sure your home attracts buyers and receives an offer? You accomplish this the same way it has always been accomplished. The process to market and secure a buyer for your home remains unchanged even though it is a short sale.

- Proper Pricing. A home priced correctly will always attract the attention of buyers qualified in that price range. One of the first steps should be to research sales in the area in order to determine a price that is not to high or to low. Listing the home at real market value will result in offers.

- Market the home correctly. What makes your home standout from the competition besides the price and the fact that it is being sold as a short sale? Don't let yourself be short changed by the marketing efforts of the agent you hire. MLS comments are require to notify all that the home is subject to a short sale but even with the proper disclosure verbiage, there is plenty of room to describe features and amenities that buyers will find desirable. You should expect to receive full marketing efforts from the company you hire.

- Choose and experienced agent. It is important to make sure the agent you hire has short sale experience. When I say experience I am talking about not just in listing short sales but in getting them to the closing table. Ask if the agent has any formal training. Do they have the CDPE designation? Certified Distressed Property designated agents understand the process from beginning to end and are more than capable of helping you out of your situation by selling your home.

I understand you are under a tremendous amount of stress right now. You can reduce some of your stress by listing, receiving offers, negotiating with your lender and closing the sale with an agent who knows how to compete and win against the competition.

Oct 21, 2009

Kissimmee haunted house is the perfect scare this Halloween!

- October 23

- October 24

- October 30

For more information about the Kissimmee haunted house call 407.847.2388.

Speaking of houses, It does not have to be scary to sell or buy a home in Kissimmee.

Orange City Halloween Block Party

The Halloween festivities include:

- A haunted house

- Live Music (dead music would seem more fitting being Halloween and all)

- A rock wall

- Games & prizes

The event should be fun for everyone! Detailed info

House worth less than mortgage?

Are you caught in a situation where you owe more on your mortgage than your house is worth? Have you recently lost a job, been ill or faced some other hardship that now has you behind or about to fall behind on mortgage payments? Don't give up, there may be help available for you.

Call your lender immediately. It may be possible for you to make arrangements to catch up on missed house payments or even modify your existing mortgage reducing your monthly obligation.

Speak to a HUD approved housing counselor. The Government have programs in place designed to assist home owners facing foreclosure.

Talk to a short sale expert. As a Certified Distressed Property Expert, I can walk you through the process of selling your home for less than owed on the mortgage with your lender's approval.

Call me for a confidential discussion about your personal situation.

Greg Staker

407-304-0255

Watson Realty Corp.

Oct 17, 2009

Are your expectations in line with the current Florida real estate market?

Buyers

- Are you aware that short sale transactions can take longer to close than traditional deals?

- Did you know that bank owned/foreclosed property will often receive multiple offers which will push the final sales price higher than the initial listing price?

- Time is running out in order to take advantage of the first time home buyer tax credit and there are no guarantees the credit will be extended.

Sellers

- Over pricing your home is not a good strategy in this market. Testing the market usually results in a failing grade.

- Trying to short sale your home simply because it is no longer worth what you paid for it is not considered a valid reason by your lender.

Buyers and sellers need to manage their expectations. My job is to make sure that you know going in what to expect, and to explain how we can work together to make sure you receive favorable results.

Related Florida real estate views:

When is a building permit required in Casselberry

- Building a new residential or commercial building.

- Maintenance and repairs exceeding $500 in labor and materials.

- Electrical work.

- Replacing air conditioner unit.

- Installing water heater.

For specific work please call the City of Casselberry or visit their website.

Related Florida real estate views:

Oct 13, 2009

You can receive alerts when offenders move into your neighborhood

Listen to the Florida Offender Alert System public service announcement.

Oct 8, 2009

10,000 square foot house

According to results from today, there are 27 homes listed for sale right now that have at least 10,000 square feet. Prices range from $900,000 to over $12,000,000. The largest home listed is in Isleworth coming in at over 16,000 square foot.

The home mentioned in The Wall Street Journal has a dance floor. I am sure we can find a spot in anyone of the 2 dozen plus big homes for sale in Central Florida for a little boot scootin boogie.

Oct 4, 2009

High End Property Deals

High end property are those houses and condos listed for $1 million or more listed in the Orlando-Kissimmee, Central Florida market.

High end short sales

In the 4 county area, Osceola, Orange, Seminole and West Volusia right now there are nearly 3 dozen homes listed above 1 million that are subject to a short sale. These include homes that are:

- Custom homes

- Homes on ski lakes

- Acre + lots

- In gated communities

- Situated on a golf course fairway

Starting list prices run up to $3.5 million.

High end REO

Our market also includes a handful of REO/bank owned high end property. These homes offer heated square feet ranging from 4000-8000 and have construction dates from 200-2009.

There are deals available in all price ranges. For additional details, give me a call.

Related Florida real estate views:

What will 5 million buy you in the heart of Central Florida?

Oct 3, 2009

City of Longwood Halloween Event

- Costumes contest

- Candy

- Bounce houses

- Games

- Food

Please visit The City of Longwood for more information.

Lake Mary Halloween Trick or Treating

The Spooktacular will include:

- Costume Contest

- Music

- Candy

- Games

- Fun, fun, fun!

The event will be held in Central Park in Lake Mary.

3 common code violations in Casselberry

In Casselberry, the city will use code enforcement to make sure everyone works towards the same goal of maintaining property values, safety and overall appearance and condition. 3 common code violations in Casselberry are:

- Failure to take care of your yard. The grass needs to be cut, fallen limbs and brush needs to be picked up and disposed of.

- Not getting rid of the broken down clunker. Disabled and/or unlicensed vehicles have a home in the junk yard and not your front yard.

- Allowing trash to collect. Trash belongs in a can and not all over your lawn or neighborhood.

You can visit Casselberry's information page to find 7 other common code enforcement violations.

Halloween at Cranes Roost Altamonte Springs

- costume contests

- inflatable games

- live entertainment

The event will be held on October 31, 2009 from 5 p.m. - 9 p.m. Visit the Altamonte Springs city website for detailed information.

Florida to receive grant to assist with unemployment systems

- modernizing systems

- speed up payments

- improve overall program integrity

The goal will be to strengthen the infrastructure so that those out of work can rely on collecting their unemployment money while actively searching for new employment.

Sep 30, 2009

Florida homeowners are invited to a community forum on the housing crisis

Hosted by the Attorney General Bill McCollum and the Florida InterAgency Mortgage Task Force this event will offer homeowners an opportunity to receive valuable information dealing with:

- affordable housing

- loan modifications

- alternatives to foreclosure

- buying and selling real estate in the current market

- mortgage fraud

- foreclosure procedures

- scams targeting those in default on their mortgage

Volunteer lawyers and HUD-certified housing counselors will be available for questions. You are encouraged to register by calling 877-385-1621. For additional information please visit the Attorney Generals website.

Sep 28, 2009

What can we do to increase our chances of having a bank accept our offer on their home?

Bank owned properties are a hot right now in the Central Florida area. Investors, first time homebuyers and buyers looking for good deals are competing against each other presenting offers on available properties as soon as they hit the market. While there are no guarantees, a buyer and their agent can take steps to increase their chances of having their offer accepted.

- Are you offering less than asking price? The time for testing the market or making low offers to sellers, especially sellers who are banks is gone. It is a seller’s market for banks and their listing inventory. Ask your agent to provide you with research for the area. Are bank owned property selling above list price? If so then offering less will continue to result in rejection.

- Make them an offer that is hard to refuse. Will your purchase be subject to financing? Strengthen your position by getting approved. Make sure the financing approval letter provided to you by your lender is strongly worded leaving no doubt that financing is not an issue. Being approved should allow you to shorten the contract time period from offer to closing. Instead of 30 days can you now close in 15? The cleaner the offer in terms of contingencies and time frames increases the chance your offer has of being accepted.

- Look for older inventory. There are situations when even bank owned property do not sell immediately upon hitting the market. Perhaps they were priced to high at the onset and the bank refused to negotiate early on. These same listings may now have received price reductions that make them good deals but since they are no longer fresh, they are ignored by buyers and their agents. Have your agent pull bank owned property that have spent a few months on the market and look for those with price reductions.

These suggestions may help you purchase a bank owned property. Of course there is more that just bank owned property on the market right now. You would be wise not to dismiss the regular home owner trying to sell their home. Short sales and motivated sellers/builders are offering some very good deals as well in this market.

Related Florida real estate views:

Most home buyers need to obtain financing in order to buy their home.

Making an offer at or above list price may be a wise decision.

Sep 26, 2009

FDLE reports crime down in Florida in 2009

The report shows a decrease in:

- Murders - 18.8%

- Robberies - 13%

- Motor vehicle thefts - 23.1%

You view the full report by visiting the Crime in Florida Semi-Annual Report.

Related Florida real estate views:

Sep 23, 2009

Where can I find the best selection of homes on 5 acres in Central Florida?

When you say "best selection" I am assuming you are talking about price, size and number of homes available. In order to narrow down the results I limited my search for an answer to your question to include only 3 bedroom minimum, 2 bath minimum, block construction on 5 acres. I searched 5 of the Central Florida counties, Osceola, Seminole, Orange and Volusia.

- Volusia County 22 homes priced between the mid $100's to over $2 million

- Seminole County 31 homes priced between the mid $200's to over $1 million

- Osceola County 28 homes priced between the mid $200's to over $1 million

- Orange County 16 homes priced between the low $300's to nearly $6 million

Osceola County has the biggest selection at this time with Volusia having the lowest prices and Orange County the highest.

We are looking to buy a condo in the Orlando area priced between $300,000 - $400,000

In order to provide you with information I checked out condos that were listed and sold this year between $300,000 and $400,000. Condo associations that have units selling in this price range include:

- Artisan Club in Celebration

- Moorings on Lake Maitland in Maitland

- Sactuary in Orlando

- Carlyle Residences in Celebration

- Eola South in Orlando

- Vizcaya Heights in Orlando

- Paramount on Lake Eola in Orlando

I am available to provide you with a complete list of condos for sale and additional details including making arrangements to view any condo listed.

Related Florida real estate views:

How does buying a short sale impact a home buyer?

When buying a condo, the seller should provide you with specific documents

Sep 20, 2009

Save my home from foreclosure

One of the initial messages the FDIC would like to get out is that you are not alone. As a real estate agent in the Orlando-Kissimmee Florida area I can tell you for a fact this is the truth. What has happened to the economy over the past couple of years hurt innocent home owners like yourself.

The good news is that there may be help for you. The key to this help is in communicating. Communicating with your lender or loan services. I realize for many this is a hard call to make initially but if it helps prevent you from losing your home, isn't it a call you should make?

Ask about modifying your loan. Many lenders and services are working with distressed home owners with the goal of keeping them in their homes. Be persistent, follow up and make sure you provide the modification department all of the documents they need in a timely manner.

You can find more information about saving your home by visiting:

Florida home loan modification - Fannie Mae

In order to be considered for modification you will need to be living in the home as your personal residence and originated the mortgage before January 1 , 2009.

You can call Fannie Mae or your lender to find out if your loan is a Fannie Mae loan. The number for Fannie Mae is 1-800-7FANNIE. Or you can look up your loan here.

To learn more about this program including additional eligibility requirements, visit Making Home Affordable.

Related Florida real estate views:

The time it takes to close a short sale transaction

Fannie Mae sells homes

Sep 19, 2009

City of Orlando zoning information

You can review the city zoning maps by visiting the City Planning Division or you can visit the Orlando zoning page to view maps. You can also call 407-246-2269 for more information.

Related Florida real estate views:

If you are buying a home with the Orlando city limits, you may qualify for a loan up to $8,000

Does anyone know of a good FHA lender in Orlando?

Sep 17, 2009

7 suggestions for spending your $8,000 first time homebuyer tax credit

- Buy another property with cash. As of this post there are over 2o properties listed for sale in Central Florida priced at $8,000 or below. These listings are either condos or manufactured homes.

- Buy a new computer monitor. NEC CRV43

- You could by an arcade/video game. Grand Daddy

- Launch a personal Satellite. Interorbital Systems

- Buy a camera. Nikon D3X

- Buy a 'Battlestar Galactica' figure. Cylon

- Something nice for your new home. Chandelier

Of course don't forget you could also donate the money to charity. The key is that you will miss out on the opportunity to spend the extra 8 grand if you do not buy a home before the deadline expires. Give me a call to find out if you qualify for the first time home buyer tax credit.

(Please check with manufacturer or dealer for price, availability, tax, shipping and handling fees and anything else that is important to you before buying any of the items listed above. I have no own or have a business relationship with any of the companies listed.)

Related Florida real estate views:

The following video offers an explanation of the first-time homebuyer tax credit.

First time home buyer tax credit is available to Florida home buyers

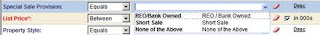

The MLS has made it easier to find you the homes you are interested in.

- REO/Bank Owned. Buyers looking for homes that were foreclosed on and are now being sold by the many lenders in this country will want us to select this option.

- Short Sale. Buyers who are interested in seeing only those homes where the seller is selling subject to a short sale contingency will expect the agent to select this option.

- None of the Above. Buyers who are not interested in seeing bank owned or short sale listings will want us to search for homes from this category.

Do you have a preference? Let me know and we will create a custom home search designed just for you.

Related Florida real estate views:

I have heard if I buy a house I will get $8,000, is this true?

I would not buy a house in Florida without first...

Sep 16, 2009

How long does the short sale process take?

The Florida Association of REALTORS created a short sale addendum to the purchase and sales contract that a buyer and seller can use to negotiate time limits for acceptance and additional time periods. The addendum allows for the buyer and seller to agree in writing to the length of time the seller’s lender has to approve the purchase price and contract terms. The default time allowed is 45 days from the effective date of the contract.

Of course the time periods agreed upon cannot be guaranteed and are subject to a third party who is not part of the contract and who could simply choose to ignore the contract.

You can avoid unnecessary delays by working with a professional real estate agent who understands the short sale process and knows how to market your home for the best price in the shortest time period. If you need to sale your home and are curious to learn more about the short sale process, contact me today.

Related Florida real estate views:

How does buying a short sale impact a home buyer?

The buzz on working with short sales

Does a short sale impact your FICO® credit score the same way a foreclosure does?

HUD website to have a new look

Related Florida real estate views:

A HUD home is defined by HUD as a residential property acquired by HUD

HUD has announced that it is offering $4 million in grant money

Sep 14, 2009

Do not fall victim to fraudulent, deceptive or unfair foreclosure rescue consultants

Sep 13, 2009

Researchers to present their Chinese Drywall findings

- Analysis of materials

- Emissions Testing

- Exposure Assessment and Toxicology

- Remediation/Repair

- Disposal

Hopefully there will be additional details and information available about Chinese Drywall after the symposium.

We present buyers and sellers with addendum that alert them to the importance of inspecting for and disclosing any know Chinese Drywall issues. We encourage home buyers to obtain all of the inspections they deem necessary before closing.

Related Florida real estate views:

Have a pest inspection company inspect your home before you purchase your home

You can buy a 3 bedroom Orlando home for under $100,000.

Search for homes

Sep 12, 2009

Forget ants in your pants. How do you prevent ants in your house?

These steps include:

- Eliminate sources of moisture or standing water near a home

- Keep food in sealed containers

- Dispose of garbage regularly

- Keep pet food and water dishes clean and remove any spilled food

- Seal cracks and holes around a home

These are all good common sense precautions that everyone can and should follow. You can also use the services of a professional pest control company. Having a pest inspection company inspect your home before you purchase your home and then having them follow up with regular check ups will reduce your chances of having ants or other pests in your home.

Photo credit: Qfamily

Related Florida real estate views:

Hire a professional to inspect the home