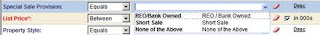

List of short sales

The market has a good supply of homes listed for sale with the short sale contingency. The fact that these homes can often be purchased at competitive prices make them very attractive to first time home buyers and investors. It is because of this demand, I have decided to offer a list of short sales to qualified buyers who contact me. You will need to let me know the area and the price range that you are interested in and I will email you the latest listings.

Orange, Osceola, Polk, Lake, Volusia and Seminole

The market area I cover includes short sales listed in Orange, Osceola, Volusia, Seminole, Lake and Polk counties. The number of available short sales vary by county, as of this post the counties mentioned above have the following inventory.

- Orange County - 3184 listings

- Osceola County - 1199 listings

- Volusia County - 664 listings

- Polk County - 1039 listings

- Lake County - 617 listings

- Seminole County - 933 listings

These numbers are subject to change daily and are based on information from MFRMLS for the period September 6, 2009.

Related Florida real estate views:

Is it possible to get a short sale approval in an hour?

HUD is committed to streamlining and speeding up the short sale process

The effective date of a short sale contract